If you’re unsure whether or not opening a gold IRA is best for you, seek the advice of a certified monetary advisor. Custodians are responsible for ensuring that all property are compliant with IRS rules. Colin Plume based Noble Gold Investments in 2016. The company is dedicated to guaranteeing that each investor understands every aspect of their funding. Or you would have to work with a company that gives a home Storage IRA solution if it’s something that you just insist on doing. There are requirements you will need to meet to make sure your bodily metallic is IRA-eligible, and you will need to work with an IRS-authorized custodian to take care of your gold or silver bullion for you. It’s a reputable enterprise in the sector and has been providing investment alternatives for over 15 years. Birch Gold majors in offering precious metals IRA permitting you to own a number of precious metals via your retirement account.

If you’re unsure whether or not opening a gold IRA is best for you, seek the advice of a certified monetary advisor. Custodians are responsible for ensuring that all property are compliant with IRS rules. Colin Plume based Noble Gold Investments in 2016. The company is dedicated to guaranteeing that each investor understands every aspect of their funding. Or you would have to work with a company that gives a home Storage IRA solution if it’s something that you just insist on doing. There are requirements you will need to meet to make sure your bodily metallic is IRA-eligible, and you will need to work with an IRS-authorized custodian to take care of your gold or silver bullion for you. It’s a reputable enterprise in the sector and has been providing investment alternatives for over 15 years. Birch Gold majors in offering precious metals IRA permitting you to own a number of precious metals via your retirement account.

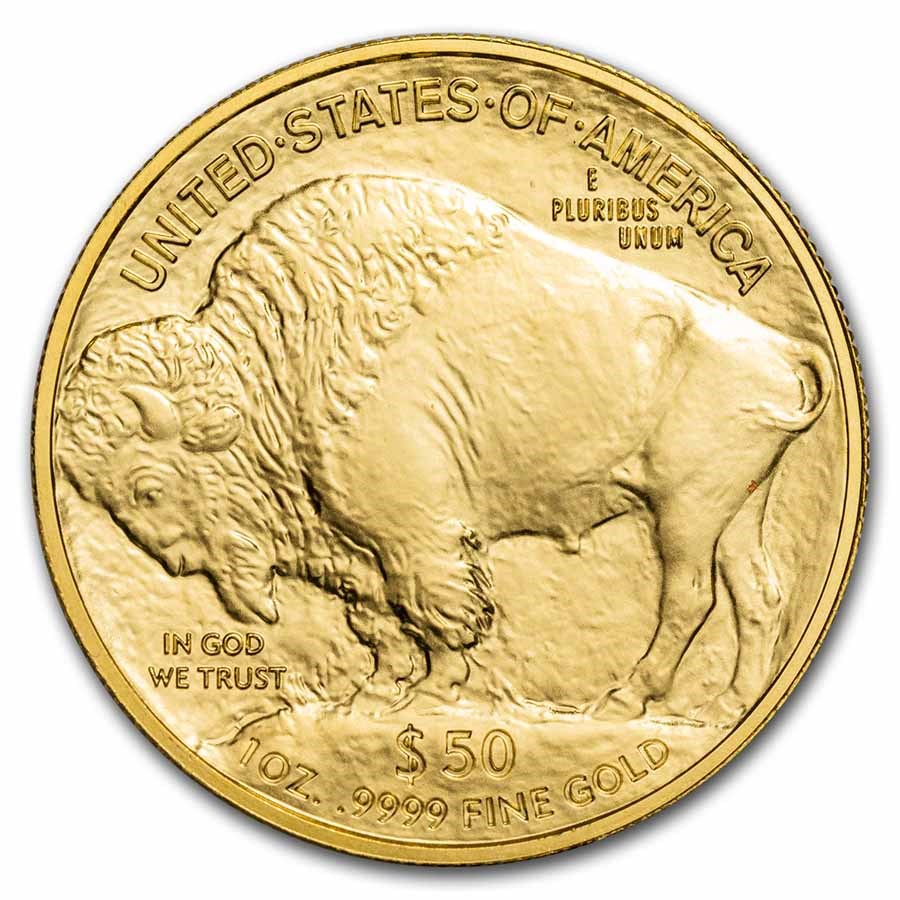

Restricted client base. Birch solely serves clients throughout the United States. Gold has a stable worth that is prone to proceed to rise sooner or later but has decreased in price within the last two years. Birch prides banks on its popularity and customer-friendly workers to retain customers. FSLR’s steering supplies perception on the affect of the IRATC. Importantly, the IRATC bonus could present a possibility for FSLR to revise up their $700 IRATC steerage. If you have any concerns with regards to the place and how to use investing in a gold ira (Investwight.Com), you can get in touch with us at the web-site. By opening a self-directed IRA, you are offered with an opportunity to invest in a wide range of property, together with gold and different valuable metals reminiscent of silver, platinum, and palladium. Assured by the Canadian Government for weight, purity and face value, the Palladium Maple Leaf is legal Canadian tender with a face value of fifty Canadian dollars. All these uses of silver, which we assume is a considerably non-renewable resource, will finally mean that the demand for this substance will outweigh the provision. Not solely can you add valuable metals like gold, silver, platinum, and palladium to your account, you may fund it with cryptocurrency as nicely. Unclear pricing. Prospects can’t entry up to date costs for coins and bars on their web site. Word that you’ve complete control over your gold belongings that the custodian purchases in your behalf, as nicely access to your depository, supplied that they are both authorized by the IRS.

Restricted client base. Birch solely serves clients throughout the United States. Gold has a stable worth that is prone to proceed to rise sooner or later but has decreased in price within the last two years. Birch prides banks on its popularity and customer-friendly workers to retain customers. FSLR’s steering supplies perception on the affect of the IRATC. Importantly, the IRATC bonus could present a possibility for FSLR to revise up their $700 IRATC steerage. If you have any concerns with regards to the place and how to use investing in a gold ira (Investwight.Com), you can get in touch with us at the web-site. By opening a self-directed IRA, you are offered with an opportunity to invest in a wide range of property, together with gold and different valuable metals reminiscent of silver, platinum, and palladium. Assured by the Canadian Government for weight, purity and face value, the Palladium Maple Leaf is legal Canadian tender with a face value of fifty Canadian dollars. All these uses of silver, which we assume is a considerably non-renewable resource, will finally mean that the demand for this substance will outweigh the provision. Not solely can you add valuable metals like gold, silver, platinum, and palladium to your account, you may fund it with cryptocurrency as nicely. Unclear pricing. Prospects can’t entry up to date costs for coins and bars on their web site. Word that you’ve complete control over your gold belongings that the custodian purchases in your behalf, as nicely access to your depository, supplied that they are both authorized by the IRS.

The IRS has strict guidelines when it comes to regulating gold-backed IRAs. Treasured steel investments have to be saved in a secure depository designated by the custodian, and this depository must be insured and meet all necessities of the IRS. This option requires a storage solution, whether you work with a 3rd get together to store your funding or keep it in a protected at residence. Goldco requires clients to purchase all holdings by means of them. Amid this backdrop and with a new year upon us, it could also be an ideal time to reassess your investments and fine-tune your monetary goals for 2023. Many traders wish to spend money on gold, which is commonly seen as a protected haven for your holdings. As of December 2019, the federal government debt to banks reached 3,880,000 billion rials (approx.

Nonetheless, no precious metals IRA supplier can influence the worth of your precious steel property. I’ve occasionally mentioned that a wider range of outcomes for the worth of a given asset signifies higher danger. If you are utilizing gold or silver as a method to add some stability to your portfolio and hedge against large swings in different markets, you may want to consider volatility before you buy. Augusta provides a buyback program that makes it straightforward so that you can get the value for your cash while you need quick cash. That said, online research means that the minimal account opening balance at American Bullion is $50,000. You possibly can choose to receive a coin or bar. They’ll information you thru the account setup procedure, assist with switch or rollover of your current IRA, in addition to help purchase and store accredited gold merchandise to your account. These fees come from sourcing IRS-accredited coins, paying for secure storage that complies with IRS rules and account setups. You’ll be able to apply for a gold backed IRA if you’re over age seventy two and earn sufficient to cover your taxes. You possibly can take distributions in the type of cash or having the gold transferred to an exterior account, subject to taxes and potential penalties. Major unrest leads to issues about being extra secure with investments. Enphase will not instantly benefit and the impact will likely be smaller, plus administration identified near-time period macro considerations as a result of higher curiosity charges affecting their enterprise.